south dakota property tax laws

The South Dakota SD state sales tax rate is currently 45. How they apply to your business refer to South Dakota laws administrative rules and publications on our website at httpsdorsdgov or call 1-800-829-9188.

Property Tax South Dakota Department Of Revenue

Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws.

. Rules Concerning the Certification of Assessing Officers. In South Dakota the most common types of jointly-owned property are joint tenancy with the right of survivorship and tenancy in common. General Property Tax Rules.

Property Tax Codified Laws. State law provides several means to reduce the tax burden of senior citizens. Laws 47-22-1 et seq.

South Dakota Nonprofit Corporation Act SD. So even money you earn from a post. 2022 - SD Legislative Research Council LRC Homepage SD Homepage.

Homestead laws provide an exemption for the family home. If someone from another state leaves you an inheritance check local laws. South Dakota does not levy several taxes that other states impose such as a state income tax.

Ad valorem refers to a tax imposed on the value of something as opposed. The last thing you want to deal with is missing a tax payment. Office of the State Treasurer Unclaimed Property Division 124 East Dakota Ave Pierre SD 57501-5070 Phone.

Sales and property tax refunds and property tax freezes are available to seniors who. 128 of home value. Legislative Research Council 500 East Capitol Avenue Pierre SD 57501.

6057733379 or 8663572547 Fax. 2021 South Dakota Codified Laws Title 10 - Taxation Chapter 06B - Property Tax Reduction From Municipal Taxes For The Elderly And Disabled. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

Depending on local municipalities the total tax rate can be as high as 65. 2021 South Dakota Codified Laws Title 10 - Taxation Chapter 13 - Property Tax Relief. Article 2069 - Real Estate Brokers and Salespersons 217 W.

SDCL 10-1 Department of Revenue. Property Tax Codified Laws. South Dakota also does not levy the gift tax but the federal gift tax applies on.

However other states may tax people or property within South Dakota baseon those states. Counties that lowered property. The decades that followed saw the creation and.

There is no requirement that a community association manager or condo association manager in South Dakota hold a real. South Dakota Community Association Management Licensing. Administrative Rules of South Dakota ARSD Regulated by the Commission.

Tax Breaks and Reductions. Section 10-6B-1 - Definition of terms. Tax amount varies by county.

If you obtained real estate in. Other local-level tax rates in the state. Title 10 Codified Laws on Taxation.

Minnehaha County SD Property Tax Appeals Law Firms. In 1983 South Dakota became the first boutique dynasty trust jurisdiction without state income taxes. Law Firms Lawyers 2 results AV.

Brandon Blahnik CC. Tax Basics South Dakota Taxes. Inheritance taxes are imposed upon the deceaseds heirs after they have received their inheritance.

Section 10-13-1 - 10-13-1 to 10-13-10Repealed by SL 1992 ch 84 11. Residents above the age of sixty nine can also shield property valued at 170000 from being sold to pay off state. - Pierre SD 57501 Phone.

In this section you will find information about your rights as a tenant including the right to not be discriminated against in addition to homestead laws meant to prevent struggling homeowners. SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in. The property tax is an ad valorem tax on all property that has been deemed taxable by the South Dakota Legislature.

The law governs the corporate structure and procedure of nonprofit corporations in South Dakota. Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws. Unique South Dakota Laws.

Understanding Your Property Tax Statement Cass County Nd

Property Tax South Dakota Department Of Revenue

New Municipal Tax Changes Effective January 1 2022 South Dakota Department Of Revenue

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

Pin On Managing Properties Pioneer Managed

South Dakota Property Tax Calculator Smartasset

Property Tax South Dakota Department Of Revenue

Understanding Your Property Tax Statement Cass County Nd

9 States Without An Income Tax Income Tax Income Sales Tax

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

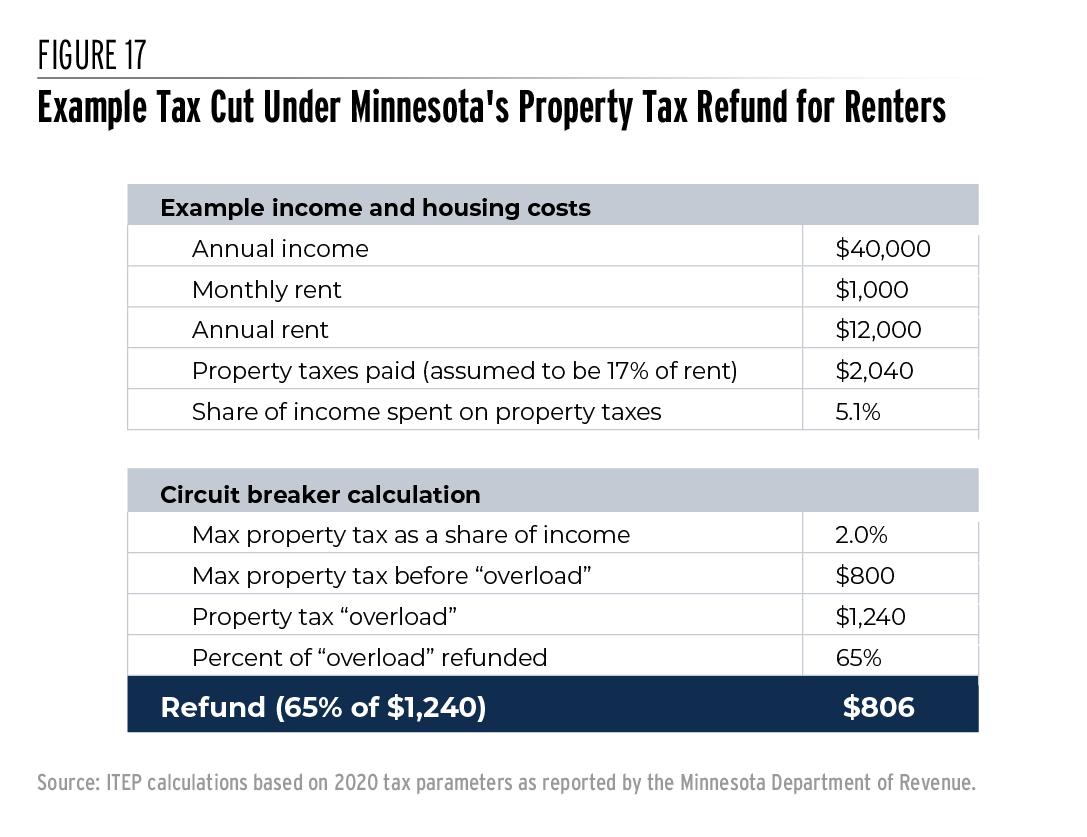

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Illinois Quit Claim Deed Form Quites Illinois The Deed

Property Tax South Dakota Department Of Revenue

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)